Donate Real Estate

Beneficial

Reduce capital gains taxes.

Flexible

Increase your income stream.

Far-reaching

Lower your transfer expenses.

Donate real estate. Support our mission to help the most vulnerable.

Your Property + Our Mission = Lives Changed

The proceeds from your generous real estate donation will help the most vulnerable among us — children, seniors, veterans, the hungry and the unsheltered — land on their feet. And you will be eligible to receive a tax deduction based on the property’s fair market value.

Donating real estate is easy!

To get started:

- Contact our knowledgeable, professional staff and get an initial evaluation of your property.

- Sign a donor agreement and have a formal appraisal done.

- Complete your donation.

Does your property fit the bill?

CCUSA accepts the following:

- Single family and multifamily residential

- Retail, office and industrial

- Agricultural

Questions? Contact us.

Will Flores

Senior Director, Online Giving

571-527-3289 | Email

The Impact

Your gift to Catholic Charities USA is more than a one-time donation. The impact of your generosity and support of the Catholic Charities mission will long be felt.

30M

Meals provided

620,000

People received behavioral health and wellness services

38,000+

Permanent housing units for families, seniors, veterans and others

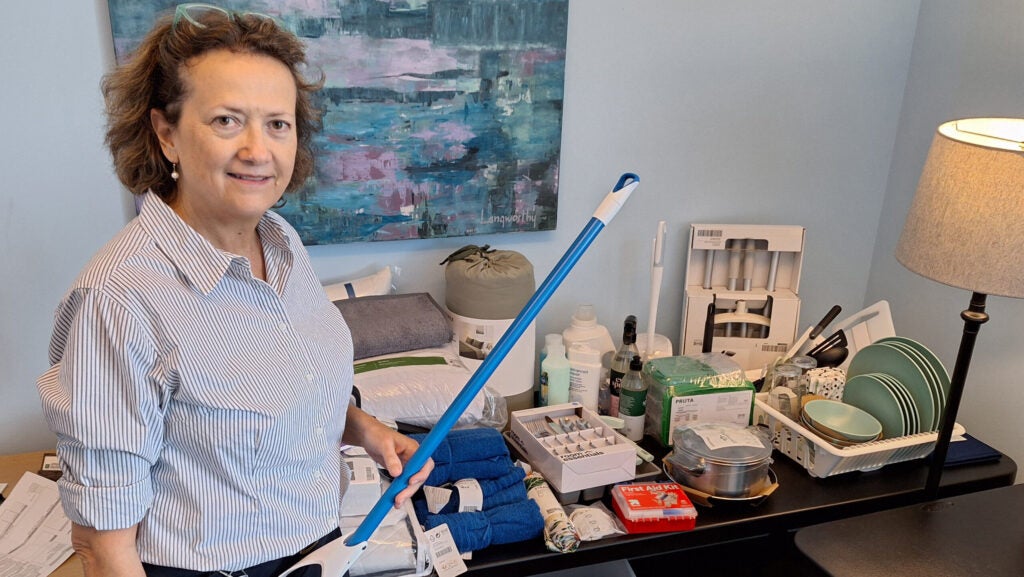

Catholic Charities cared for me as a child. Donating our house was a great way to support CCUSA’s mission in return.

Henry was adopted through Catholic Charities. He and his wife wanted to give something back to the ministry that provided him a safe and loving home as a child.

5 simple steps to donate real estate

We make it easy for you to start the ball rolling. Read here or download a step-by-step breakdown of the donation process.

Make an inquiry about your property donation. A representative from CCUSA will speak with you to gather property information.

CCUSA will make an initial evaluation of the property’s suitability for donation, which is usually completed within 24 hours.

The donor then submits CCUSA’s non-binding letter of intent (LOI) form, beginning a 10-day due-diligence period.

When the donation agreement is signed, CCUSA assumes responsibility for the process. Often, the donor’s only obligation is to secure the appraisal, which is fundamental to the donor’s claim for a tax deduction.

CCUSA sells the property and retains the net proceeds.

FREQUENTLY ASKED QUESTIONS

Still wondering how real estate donations work?

Whether it’s the kinds of property CCUSA accepts, the potential tax benefits or the ways your generosity supports CCUSA’s mission, we have answers.

Ready to learn more?

One of our knowledgeable staff members will reach out to explain how a real estate donation can work for you and your future plans.